Opening the municipal checkbooks

One of government’s most basic functions is collecting and spending money. There’s a reason budgets and spending are often the source of passionate town hall debates and a key aspect of political platforms — people care about how government is putting their money to work. Making budgets and spending transparent by putting the information online would seem like a logical starting point for any government working to be more open, but this data can still be difficult to find in some municipalities around the country.

Here, we take a look at the current landscape of how this information is shared, highlight some of the impacts of making the information available, and share recommendations for how local governments could improve financial disclosure.

The current landscape

Current financial transparency efforts among local governments show a wide range of approaches. More than half of the country’s biggest cities are sharing government spending “with checkbook-level detail,” according to a 2013 report by the U.S. Public Interest Research Group (PIRG), but the level of detail, accessibility, and ease of reuse of financial data does not necessarily appear to be tied to a place’s size. The current landscape shows that it is possible for governments of small and large municipalities alike to be more transparent with this information.

Covering the basics

While many municipalities do post information about the current budget, a budget is just a projection. The public needs to be able to examine the actual flow of money in and out of government. Places such as Harrisonburg, Va., Tucson, Az., Woodbury, Mn., and Bellingham, Wash., are just a few examples of the local governments that, unfortunately, only appear to share budget information online.

The accessibility of that information varies greatly, too. For some of the places sharing budget information, the data is locked up in PDFs with text that cannot be searched or easily extracted for further analysis. Other times, it is in a machine-readable format but there is no option to easily download the data.

Minimal proactive disclosure

Some municipalities are doing a better job of sharing more than budget information and making that data reusable. Houston, Tx., goes beyond budget data by posting monthly financial reports showing details about revenues and expenditures (along with information about debts and other financial matters). Unfortunately, this information is in a non-searchable PDF, making it hard to analyze or reuse.

Some level of proactive disclosure is certainly better than none, and there are many ways to approach it. Lee’s Summit, Mo., posts budget data in searchable PDFs and provides some details about revenues and expenditures on a web page. Cincinnati, Ohio, shares its budget documents as searchable PDFs but also has a searchable expenditure database. Amherst, Mass., has these features as well for its financial data portal, and the expenditure data can be downloaded in an open format.

Next steps

The sharing of detailed, timely financial information is becoming not only increasingly possible, but it has more opportunities than ever to be engaging. Municipalities with more advanced financial transparency are showing the potential of going beyond just sharing financial data by making it user-friendly.

Denver is one place showing the possibilities for being financially transparent. Denver’s Open Checkbook allows users to explore categories including expenditures, the budget, financial reports, revenue, investments, contracts, taxes, and property. Checkbook information can be searched or filtered by expense categories, program areas, and top payees, and most of the information appears to go back through 2010. Datasets can also be visualized and downloaded in open formats.

New York City has also worked on creating a financial transparency platform that allows searching and filtering through budget, revenue, spending, contract, and payroll information. The recently revamped Checkbook NYC is an open-source platform that allows users to download data and explore visualizations.

Los Angeles takes several approaches to sharing its financial data, with one portal dedicated to budget data and another dedicated to more complete financial information, including audits and reports, payroll, purchasing, revenue, the checkbook, liabilities and assets, the budget, and more. The data can be searched, sorted, and visualized in different ways.

One of Los Angeles’ efforts that appears to be unique is the creation of “Data Cards” to highlight interesting expenses and explain what the money went toward. Clicking on the cards shows more information about the expense, explaining things like why the City spent nearly $130,000 on 52,000 frozen rats (the answer: to feed snakes at the zoo).

Municipalities of all sizes around the country are taking similar steps toward financial transparency by sharing budget and spending data online, making it downloadable and providing visualizations. Montgomery County, Md., has budget and spending data portals that include these features and more. Similar levels of financial transparency can be found in places including Erie, Colo., Hickory, N.C., Boston, Palo Alto, Calif., Bullhead City, Ariz., New Haven, Ct., and Fort Lauderdale, Fla.

States are opening their financial data, too

Municipal governments are not alone in having work to do when it comes to financial transparency. States take a variety of approaches to sharing their financial data online, with varying degrees of success in making the information easily accessible and understandable.

A 2014 report by the U.S. PIRG examined spending transparency among all 50 states and found there is much room for improvement. Indiana, Florida, Oregon, Texas, Massachusetts, Iowa, Vermont, and Wisconsin all ranked as state financial transparency leaders according to that report, but 10 states received a “C” grade and 12 states fell into the “D” or “F” grade range. That leaves many municipalities without a state-level example to look up to for financial transparency.

Some states have clearly taken the cue to make improvements. The U.S. PIRG report released in 2014 graded Ohio on its previous financial transparency website, which received a “D-“. Ohio’s Treasurer’s Office has since launched a new Ohio Checkbook that addresses the shortcomings pointed out by the 2014 report and goes beyond fixing the shortcomings to offer some innovative methods of powering search and analysis of the state’s financial data. Hopefully other states will follow suit.

The impacts of opening the checkbooks

Some financial transparency efforts appear to be quite advanced compared to the rest of the field, but just putting the information online in easily accessible, reusable formats can have big impact and bring benefits to government and the public.

There are a growing number of examples of outreach and engagement efforts by governments that share open financial data. San Francisco held an online town hall to receive feedback from the public about the annual budget. Boston allocated some of its budget for use by teenagers, who designed and voted on projects that they decided would benefit the community. These kinds of participatory budgeting exercises are increasingly being deployed in local governments around the country, and this exercise is often empowered by being transparent about the budget in some way or another. Hopefully, the rise of participatory budgeting will spark a parallel rise in online disclosure of budget and spending information.

Governments will be facing mounting demand for sharing this data online, too. The movement to open up local financial data is spreading and leading to collaboration around the world, bolstered by groups like the OpenSpending community. The organization has a map tracking open spending efforts in cities around the world and has events pushing to expand it.

The mission of bringing greater financial transparency to municipal governments has even been a political platform in some places. Bulldog Budget launched in 2013 to highlight one Philadelphia city controller candidate’s vision for budget transparency. A call for better financial transparency was something the city needed, too. Despite being an open data leader in many ways, Philadelphia is looking to upgrade its budget system, which is still mostly paper-based.

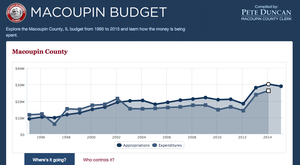

For those places where the governments have not yet taken steps to open their financial data, community groups are stepping up to help move things along and show the importance of making the information open. Committee for a Better New Orleans is working to create a website for the city’s financial data, for example. The work there was inspired by other community-driven efforts, including projects such as Look at Cook in Cook County, Ill., and Macoupin Budget in Macoupin County, Ill. These kinds of projects continue to gain momentum around the country. In Jersey City, N.J., the Jersey City Budget takes the city’s financial data out of PDFs and makes it more easily understandable. Governments should take note from their ambitious community members putting in the time and effort to make financial transparency a reality.

Recommendations for improving disclosure

Municipal financial disclosure is advancing, but it could still clearly use some guidance for further improvements. Drawing from Sunlight’s Open Data Guidelines, here are some of the key points governments should consider when opening their checkbooks:

- Create a comprehensive list of existing financial datasets

It’s hard for the public to know what financial data to expect from government without first knowing what exists. Creating a comprehensive list of financial information can help the public better understand what data is available and can help government with the prioritization process for making that data accessible online. Realistically, it may be difficult to release all of a government’s financial information at once. A prioritization process including the public should be used to help ensure high-impact data will be released as quickly as possible.

- Post line-item expenditure details where appropriate

Sharing line-item expenditure information helps provide the most detailed and accurate picture of a government’s financial status. Aside from cases where line-item expenditure details cannot be disclosed due to privacy or security concerns, this level of detail should be public record anyway, open to inspection by being proactively posted online. Coupled with the most detailed revenue information possible, line-item expenditures make it clear where government money is coming from and where it’s going.

- Appropriately safeguard sensitive information

Financial information should be reviewed for any potentially sensitive items that need to be redacted before being published. To appropriately safeguard sensitive information for privacy or security concerns, governments must weigh the public interest in accessing the information against the potential for harm. This balancing test is necessary to ensure that no more information is withheld than what needs to be.

- Share information in a timely manner in a central location

For financial information to be most useful, it should all be available in a central location online, where it will be updated in a timely manner and remain permanently. Anyone should be able to access the information without restrictions in formats that are machine-readable, and the data should be license-free so it can be easily reused.

- Publish information in bulk and consider APIs

The reusability of financial information posted online is increased if it is downloadable in bulk, which simply means the whole set of information can be downloaded at once rather than piece by piece. Governments should also consider creating an API for the information to encourage its reuse.

- Take steps to ensure data quality

Data quality is key to making sure information is accurate when it is being interpreted and reused. Ensuring data quality can also help with making information easily searchable and findable. Using metadata can help with data quality by by providing important context about how and when information was created and how it can be used. Mandating the use of unique identifiers for specific departments, programs, contracts and other line-item information can also help with accurate tracking of these entities, especially in instances where they might have similar names and could be mistaken as the same thing.

- Include information from quasi-governmental agencies

Where possible, governments should require the same standards of financial transparency from quasi-governmental agencies. These bodies may be funded by the public and make expenditures that directly impact the public. The information about those financial flows should be subject to the same transparency standards as government bodies.

- Digitize archival materials

Historical information can add important context to any dataset, and that is especially true when it comes to finances. Digitizing archival documents and posting them online can help show financial trends over time, providing a clearer picture of where things have been and where they appear to be headed.

- Post the financial laws, procedures and timelines online

Important context can also be provided by making government’s laws, procedures, and timelines relating to financial data easily accessible online. Government should make this information available from the same central, online location where the financial data is shared.