Who met most with regulators to try to shape the Volcker Rule? The big banks, of course

Today, five agencies are set to approve a final version of the so-called “Volcker Rule,” a provision in the Dodd-Frank bill intended to prevent banks from engaging in “proprietary trading” – basically trades that benefit the banks but not their clients.

While it’s unclear how Wall Street will respond to the final proposal (there is word that Wall Street may continue to try to stop the proposal by taking the fight to court), one thing is clear: the banks have done their very best to bend and shape the rule by never leaving regulators alone.

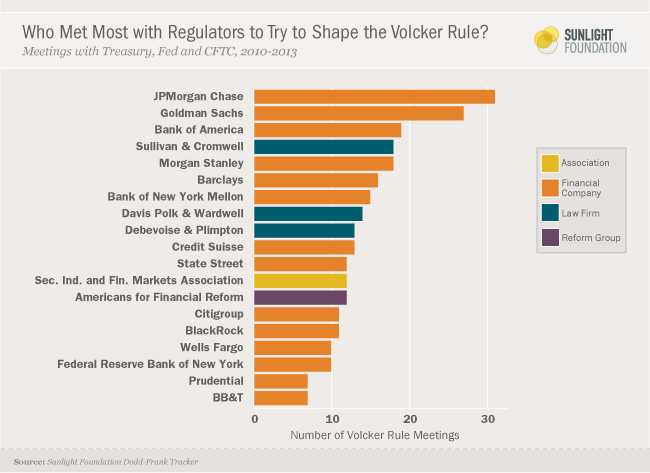

Since the passage of Dodd-Frank, the five banks most active on the Volcker Rule (JP Morgan Chase, Goldman Sachs, Bank of America, Morgan Stanley and Barclays) combined have met at least 111 times with regulators at the three regulatory agencies that reliably report their Dodd-Frank meetings (the Federal Reserve, the Treasury, and the Commodities Futures Trading Commission (CFTC)).

By contrast, the leading reform group, Americans for Financial Reform, has only been present in 12 meetings with the three agencies. The next most active reform group, Better Markets, has only attended six meetings. That puts it tied for 21st on the list of most active organizations.

Of the top 20 most active organizations (measured by meetings with the three regulatory agencies), 14 are financial institutions, three are law firms that represent financial institutions and one is the industry trade association (the Securities Industry and Financial Markets Association)

Though perhaps the most prominent rule in the Dodd-Frank bill, the Volcker Rule is just one of about 400 agency rules that the original legislation mandated. Back in July, we analyzed all Dodd-Frank meetings across the three regulatory agencies that reliably report meetings. We found overwhelming participation by the big banks.

Our analysis then and today is based on agency meeting logs data pulled from Sunlight’s Dodd-Frank meetings tracker. We’ve done our best to clean up originally messy data, though it is possible that we missed certain meetings because of the many ways in which different organizations are listed in the records. The raw, uncorrected data is available on ScraperWiki.

Unfortunately, our analysis here is limited to just three agencies. While five agencies agreed to post data online about meetings that involve outside groups regarding Dodd-Frank implementation, these reports vary in timeliness and format. Due to concerns about data quality and comprehensiveness, we excluded both the Securities and Exchange Commission (SEC) and Federal Deposit Insurance Corporation (FDIC). In the case of the SEC, the meetings are not organized in such a way that the Dodd-Frank meetings can be clearly delineated. In the case of the FDIC the meetings reporting appears very limited.

Graphic by Alexander Furnas and Amy Cesal. Thanks to Drew Vogel for his help with the data.