House passes bill reducing disclosure of dark money donors

Yesterday, the U.S. House of Representatives passed a GOP bill that eliminates the mandate for nonprofit groups to disclose their donors to the IRS. The party-line vote was 240 in favor and 182 opposed, with 12 members not voting.

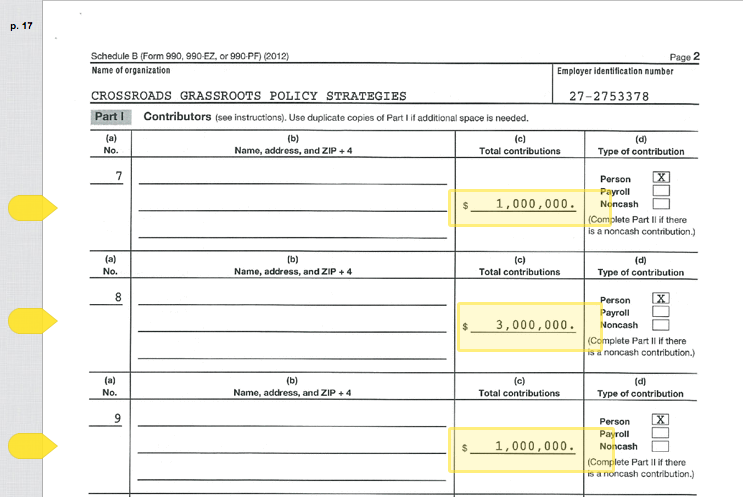

Currently, individuals who contribute $5,000 or more to 501(c) groups must report their names and amounts donated to the IRS so the agency can monitor possible charity fraud and enforce tax laws; however, this information, compiled in “Schedule B” sections of annual tax returns, is never released to the public. H.R. 5053, introduced by Rep. Peter Roskam, R-Ill., and co-sponsored by 25 Republicans, would change this so donors to nonprofits wouldn’t have to report anything at all; in fact, the IRS would be blocked from learning anything about the identities of people who contribute money to nonprofit organizations.

This misguided legislation could effectively open up a loophole allowing foreign money in elections through 501(c) groups, specifically 501(c)(4)s, that can engage in political activities. While foreign money is not allowed in U.S. elections, it can be deposited into these nonprofits — which can then spend that money in elections while keeping the identity of donors hidden. By removing the only way the government has of vetting these contributions, the bill would prevent the IRS from safeguarding U.S. elections from the influence of foreign companies and individuals.

Sunlight had joined a coalition of reform groups led by Democracy 21 in stern opposition to Roskam’s bill. A letter written by the coalition urged Congress to vote against the bill:

If donor disclosure to the IRS by 501(c) groups is eliminated, however, as the Roskam bill would do, no one will be in a position to determine if a 501(c) group illegally spent foreign money in our elections – other than the group and foreign donor involved. Any check will be gone and there will be no way to hold a group and foreign donor accountable for illegally spending foreign money in U.S. elections.

Roskam argues that Schedule B disclosures serve no real purpose and are “unnecessary.” He also cites proposals from the agency itself that would disallow the IRS from collecting donor information from some types of nonprofits. Other backers — a wide swath of conservative groups such as Koch Companies Public Sector, American for Tax Reform, the National Rifle Association and FreedomWorks — say they are trying to protect free speech and prevent further abuses by the IRS against nonprofit donors. In 2012, an IRS employee inadvertently leaked a confidential list of donors to the National Organization of Marriage, a 501(c)(3), as part of a public records request.

But officials have indicated that Schedule Bs can be useful. In a recent interview with Reuters, Hugh Jones, Hawaii’s deputy attorney general, said, “It’s important forensic data to us state regulators. It’s evidence we can consider using in an investigation to determine whether a charity’s board has breached its fiduciary duty.”

Opponents of the bill also include the Obama administration, which released a statement against the legislation, as well as Reps. Sandy Levin, D-Mich., and Xavier Becerra, D-Calif, both of whom sit on the Ways and Means Committee overseeing tax policy. “What this bill does, to put it simply, is to solidify the secrecy around the role of big money in campaigns,” Levin said. And Becerra took a hard stance against the bill, saying, “At a time when, most Americans would say ‘I want more disclosure, not less,’ the last thing we should do is give, by law, donors a license to hide their money.” He continued:

As the bill makes its way to the Senate, we wholeheartedly urge the upper chamber to protect the integrity of U.S. elections and oppose this legislation.